If you’re even a little bit informed about investment at all, there’s a pretty decent chance that you’re aware of some of the more common forms of investment out there. From mutual bonds to 401k and more, there are countless investment opportunities that most conventional wisdom would encourage you to try out. And there’s absolutely nothing wrong with any of those forms of investment at all. You will very likely try them and find at least some of them to be useful and successful in generating a return on your capital. But one thing that people tend to forget is that investment isn’t something that’s limited to a specific set of circumstances. It’s actually rather amazing just how many different forms of investment there are out there. The useful of thing about these, so-called “alternative investments” is that they aren’t quite as common or as well known. This means that the level of competition out there is significantly reduced. That’s not to say that some of these investments aren’t at least a little bit known, just that they aren’t quite the big daddies of the investment world. If you’re interested in digging a little bit deeper into some of the more unusual forms of investing that you can do, here are a few different and unique investments that you might not have thought of.

Wine

Yep. You heard me, wine. As well as being delicious and a perfect pair for any fine dining, wine has historically been an incredibly lucrative and sensible investment. Whether you love the taste of wine or not, the fortunate thing is that there are plenty of people all around the world who definitely do. Depending on the winemaker and the year it was made, a particularly fine wine can be an extremely valuable commodity for many connoisseurs. And one of the best things about it? With every bottle that’s opened, a particular wine becomes rarer, and therefore more valuable. Not only that but there is a significant amount of demand for wine coming from China at the moment. This demand is currently driving the value of wine up remarkably. However, be warned, this is far from a risk-free investment. Wine is designed to age in the bottle, so after a certain point, a bottle of wine that had previously been hugely valuable may become undrinkable and therefore worthless. Unless you’re in a position to be happy drinking your losses, be wary of this highly lucrative, but potentially risky investment.

Penny stocks

Many people with some experience with investments may have previously heard of penny stocks. But not as many people are intimately familiar with them and what it is they can provide. The clue is in the name; penny stocks are stocks that are valued at as little as under a dollar. This makes them highly speculative, offering an extremely low initial investment with the potential of a serious financial return, even in the short term. Many penny stocks have the potential to double or even triple your initial investment over the course of even just a few days. Once again, the most important thing to know about penny stocks as that they can be very high risk. There are a remarkable number of scammers out there waiting to take advantage of unsuspecting investors. The best thing that you can do to minimize that risk is by doing as much research as you can. Make sure you know everything that you need to about any company that you’re planning on investing in. There are also plenty of resources online to help you find the best penny stocks. Fortunately, even with such a high risk, the low initial investment, offset by the potential earnings make these some of the most desirable and lucrative investments for those willing to take the risk.

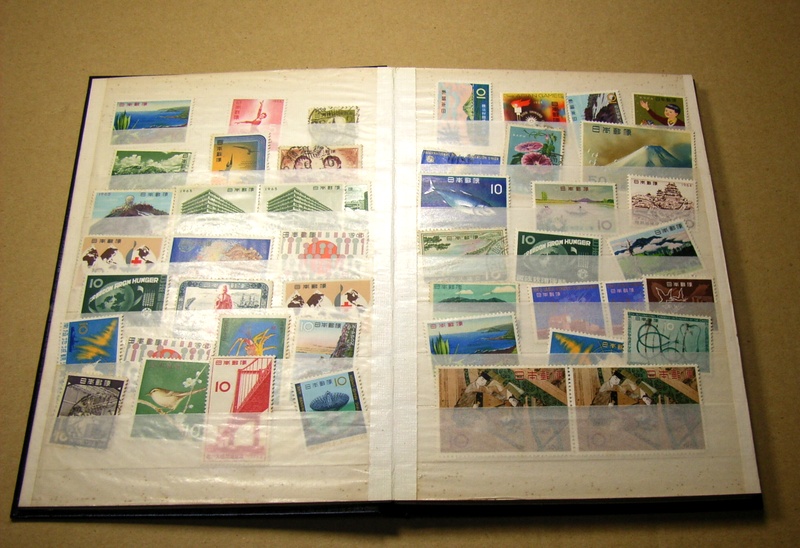

Stamps

Yes. Stamps! Those things your parents or grandparents collected into a little scrapbook and you had to pretend to care about when you went to visit. Well, perhaps you should be giving Grandpa’s stamp collection another look because in recent years the value of rare and vintage stamps has increased considerably. Unfortunately, this doesn’t apply to any and all stamps. You can just expect to make a killing off torn, common stamps. For stamps to have any value they have to be exceedingly rare, in mint condition, and they have to be authentic. The biggest trap that many people who try to invest in stamps fall into is that they get suckered in by stamps that seem to be the real deal without authenticating them. If someone wants to sell you a “rare, vintage” stamp collection, act with caution. Before any money has changed hands, have them authenticated and don’t take anyone at their word. Being able to set aside the real stuff from the fakes is the only way to be able actually to make a profit from this investment. That said, if the collection that you have is authentic and rare, then the value of those stamps is fairly static. It’s certainly not one of the most volatile investments available. This means that it’s a rather low-risk investment which can be rather tempting for more cautious types of investors.

#AskGaryVee Episode 47: How I Screwed Up My Uber Investment

Remember, no investment is a sure thing. Whether you’re investing in the more common and obvious things or you’ve decided to branch out into something a little more unusual, always be wary of the risks. Don’t ever take anyone at their word and be careful not to overreach and risk taking a severe financial hit. There are plenty of people who will attempt to take advantage of a lack of experience in the world of investment, and each investment opportunity comes with its own breed of scammers. The best advice to remember is this. If something sounds too good to be true, you can probably guarantee that it is.