There are many different kinds of trading on the market today, and if you’re not a finance expert, it’s likely that you don’t know the difference between all of them. Most of us don’t! But if you’re a savvy trader, you may be among the many people who find that they especially love to trade forex and that forex trading is the only way to trade currency.

So what exactly is Forex Trading? Many may not know that the word “Forex” actually stands for the foreign exchange, sometimes also known as “FX”. You’ll see it listed many different ways – the Forex, The Forex Market, FX, the foreign exchange, the currency market, the foreign market, and more. They all mean the same thing. Now you know what we’re talking about! FX, or Forex, is the decentralized currency exchange market where all of the world’s currencies trade. When you hear people talk about Forex Trading they’re just talking about trading globally, on a large scale, via the foreign exchange. It’s that simple!

The Forex Market is actually the largest market in the world, and it’s also the most liquid market, with a daily global trending value exceeding $5 trillion. That’s a staggering number. That’s more than the rest of the world’s stock markets – every single one of them – combined. This is one of the reasons that people flock to trade on the Forex – it is as thrilling as it can be lucrative and rewarding.

How to find the safest forex trading sites

You may have traded on the foreign exchange without even knowing it! How? Well, if you’ve ever travelled overseas and converted your country’s currency into Euros or some other foreign currency, then you’ve traded on the Forex. The exchange rate, as you have seen, fluctuates a great deal and when you convert over pounds to dollars or yen to Euros, you’re trading on the Forex via the current exchange rate. If you were to hang onto your foreign dollars for a while, waiting for the exchange rate to go up, then cashed them in for a different currency, you’d be “trading”, i.e. playing the market, buying and selling. It’s that simple. When an investor trades on the Forex, even if it is via a high-powered broker, they are essentially doing a larger-scale version of the same exact thing.

It isn’t always about trading/exchanging currency, either. It can be as simple as an American purchasing a French item online – before the purchase is completed, the American money must be converted into Euros before the seller is paid. This is a form of exchange involving the Forex.

Think Bigger Than Big: Steps to Help You Build a Global Business

As such, the Forex always involves at least two currencies. It has to in order to function. The most traded pair is, unsurprisingly, EUR/USD, or Euros and U.S. Dollars. These are always written out in abbreviations with the better performing currency listed first. So when you go to make a trade with these two currencies, you write it out “EUR / USD” because the Euro is performing better.

Essential Tools For Successful Forex Trading

Forex Trading is about more than just trading in currency on a good day, however. It is a complex and multi-faceted form of trade that involves lots of different investors and multiple different types of trading through the “spot market”, futures market and forwards markets. Forex Trading includes spot/cash markets, derivatives markets, forwards, futures, options, and currency swaps. There are many reasons while traders choose to utilize the Forex, including hedging against international currencies, managing interest rate risk, geopolitical events, and simply to diversify a portfolio. These are just a few.

Australia: Increased Internet Coverage & How Digital Marketing Is Impacting Brands

The Forex has no exact “location” – it is rather a network of global traders that exists solely “over-the-counter”, i.e. electronically. All these transactions are conducted via computer, tablet, and phone, from global traders all over the world. It is real-time, constantly updated, and accessible. The market is open 24 for hours a day, for five and a half days a week. You can find trading “epicenters” in many large cities including Zurich, Tokyo, New York, London, Frankfurt, Hong Kong, Singapore, Paris, and Sydney, among many others. Trading times depend on the time zone of a particular area, hence the Forex being open 24 hours a day. Price quotes are ever-changing, reflecting the market as it changes in real time, constantly. As the market never closes – someone is always trading around the world – the market must constantly update to-the-second to reflect the ever-changing market rates of exchange. This fast-moving system is part of the thrill that attracts so many investors to trade on the Forex.

Essentially, a version of the Forex has been around for centuries, ever since individual countries and nations began minting and trading money. However, the modern Forex as we know it, essentially began a few decades ago at the Bretton Woods accord in 1971. At this accord, major currencies were permitted to “float freely”, creating a need for a foreign exchange market to monitor these fluctuations and allow for trade. ‘

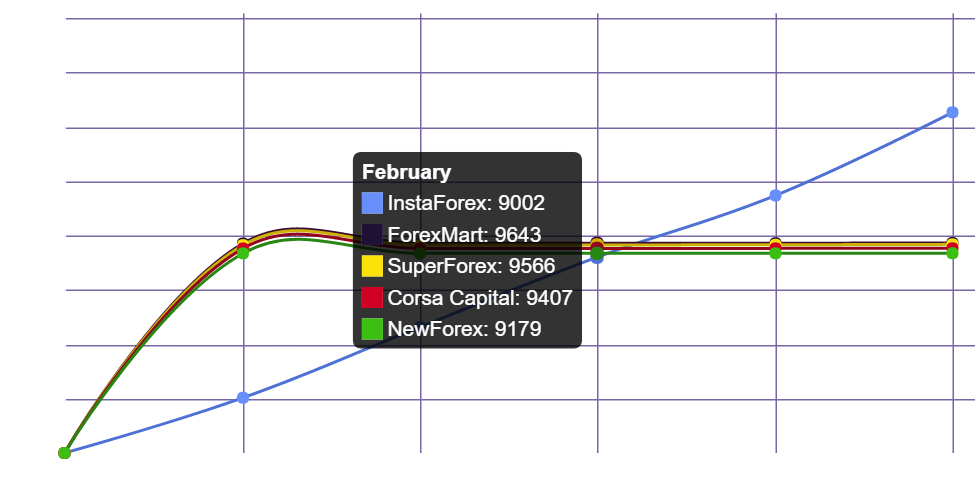

As with any trade, many will hire brokers/broker companies or enlist experts to help them make lucrative trades. Working with a broker will ensure that you’re always monitoring trades between the most traded pairs in the market as well as lesser known pairs. Your broker will keep an eye on how they are all performing for you. There are other pros and cons to hiring a broker for your trading – they’ll be able to give you results and data in real time, sometimes even from convenient tools like an app or website. They’ll do all the hard work for you, freeing up your time. There aren’t really that many cons to using a broker, other than the fact that they’ll collect a fee, and/or taxes from your trades – but that’s a given. When choosing a broker, look at the regulations in your particular country and make sure that the broker or broker company you choose is licensed, experienced and has a good reputation. Indeed, it was the advent of Forex brokers that brought Forex trading into the forefront and made the behemoth of trading that it is today. Because of these brokers, the market has seen a massive surge in activity, becoming the preferred form of trading for many.

As your broker will tell you, the spot market is where currencies are bought and sold, according to the current price. This price is determined by supply and demand, taking into consideration current interest rates, economic performance, politics and a bit of good old fashioned speculation about what the future may hold. The forwards and futures markets are different, as they do not trade actual currency. Instead, they solely deal in contracts; the futures market contracts are bought and sold based on the public commodities market, and the fowards market, contracts are bought and sold between two individuals.

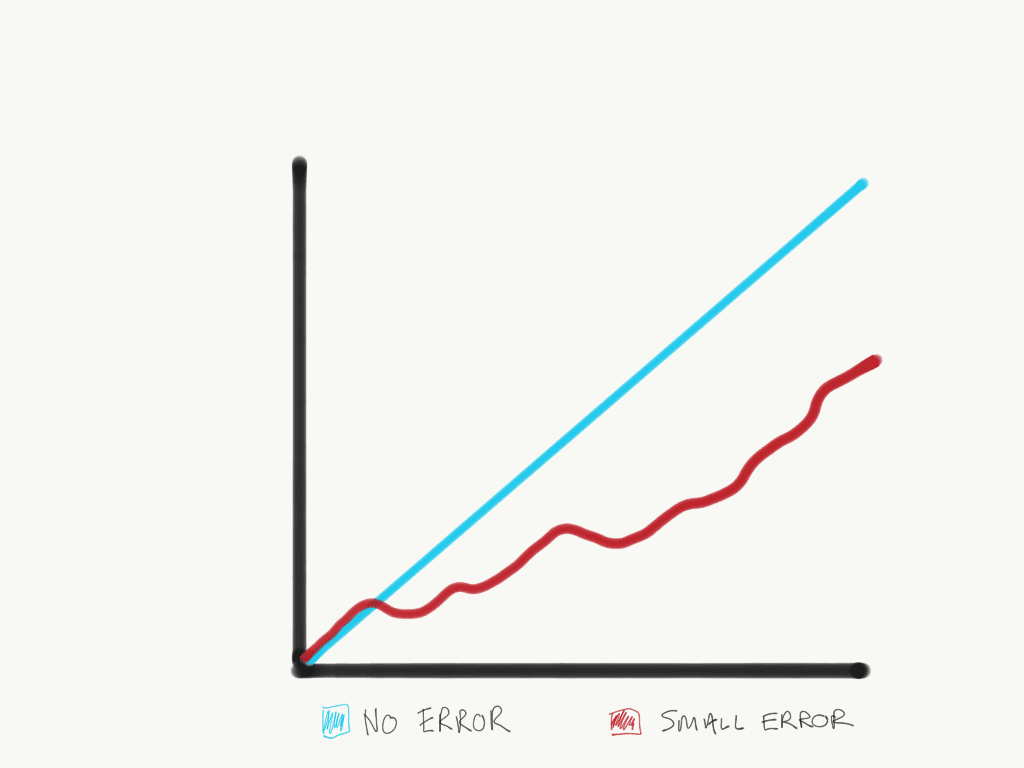

Forex Trading is perfectly legal in most countries and is very popular. Those who are well-versed in Forex Trading soon learn that there is more to just making money hand over fist when it comes to trading; there are advantages to trading even if the market is only reflecting a few cents’ difference. Sometimes, you will trade a currency just for a bit of leverage, which will ensure that banks allow you to trade more based on the money you have in leverage (usually a percentage of gains).

The Top Stocks For Entrepreneurs And Investors To Watch Out For

All sound like gobbledygook? The language of trades can be very tricky, but once you get the hang of it, you’ll be trading like a pro in no time (and if not, hey, hire that broker).

Even if you do hire a broker, experts advise that before you jump into Forex Trading, it’s a good idea to have a general working knowledge of how the foreign exchange works and operates. With a $5 trillion per day turnover, it’s an undertaking on a massive scale and you need to know the ins and outs before you begin risking your money. Learn how to read a quote, how to gain leverage, place orders, and the basics of trading. It’s all about timing – knowing when to trade and when to wait, making responsible, calculated trades, and listening to those more knowledgeable and experienced than you when it counts. Perhaps it would be advantageous to enroll in a forex course to learn the basics to get ahead of the competition.

If you’re thinking about getting into the world of trading, and are interested in learning how to trade currency via the Forex, or foreign exchange, consider speaking to a broker or broker firm about your needs. They’ll help you learn how the foreign exchange works and guide you on your investments and trades. There are many benefits to using a broker but the most obvious one is, of course, you’re less likely to lose your hat! As with any type of trading, there is always risk involved. The Forex can be high stakes to those who are inexperienced. That’s why it’s so important to research any market, including the Forex, acquaint yourself with the terms and practices involved, learn how the process works, and when you can, hire a broker to help you navigate your trading.