A foreign national that wishes to find work in Singapore can do so by working through a recruiter that will assist them in finding jobs in Singapore that suit their skills. There are various categories of posts in Singapore for foreign nationals, including housekeeper, computer consultant, medical assistant, busboy, plumber, dental hygienist, telemarketing, medical clerk, and various other entry-level jobs in the areas as mentioned above.

The Philippines is one of the countries that has been popular with many foreigners looking to work in Singapore because of the large number of jobs that are available in the country. Singapore, however, is getting more popular as the Philippines’ population has slowed down. An interesting thing about Singapore is that the number of foreigners looking to work there is increasing due to the many opportunities available that are suitable for them.

In any economy, people’s spending is determined by prices of commodities, lifestyle, and individual goals towards savings or emergencies. Your salary is supposed to cover all these costs. On a minimum, survival will require that you consume essential products and look for cheaper alternatives to the choices that are available.

Therefore, living in Singapore will require you to have an income that can support your lifestyle as well as cover the basic human requirements.

Living in Singapore as Foreigner

There are many ways to get foreigner loans. You can approach an agent, search for websites that offer loans to foreigners, or you can search on the internet yourself. The application process is easy, and most of the time is done online. The only problem when it comes to applications for a loan is how you write your application and presentation on paper.

To be able to ascertain how much one requires to live in Singapore comfortably, we will go for a deep dive into the necessary expenses people spend on including food, transport housing, clothing, education, etc. Besides, the location of a person also affects spending considerably, hence impacting on their salary and savings.

Transportation:

There are two types of transportation means one can consider; public and private. Public means of transport in Singapore involves trains, buses, and public planes. This mode of transport is much cheaper and convenient, depending on where you live. For instance, there are free rides across the city centers for those people traveling before 8.15 a.m. when the stations are supposed to open for work officially. Furthermore, charges on public transport are low. With $100 to $120, you are sorted for a whole month of rides to and from work.

A private means of traveling involves private taxis, Uber, private planes, owning a car, etc. This style is pricier than the public means. However, it has its benefits, for those who like this mode may point out the4 fact that it is convenient, time-saving, more comfortable, and secure. When it comes to private cars, purchasing, fuel, and maintenance is another headache.

Studies have shown that cars in Singapore are more expensive and that maintenance is even more costly compared to neighboring countries and other developed nations.

The best option among the two is to opt for public transport. But since it does not run around the clock, you may need to integrate private transportation on the few occasions that you get yourself out at midnight. Therefore, you will end up spending $240 on the road every month, unlike relying on private means.

Accommodation

Housing is a costly expense in Singapore, whether renting or living in a purchased home. The initial cost of buying a house is inflated, and monthly rent is also in the clouds. If you are a starter, then you can settle for a shared apartment. The renting budget in Singapore averages between $700 and $1500 monthly, for a single room or a one-bedroom apartment in the cheapest sections of the city. Citizens are allowed to purchase HDB properties—however, the monthly installment for a mortgage average from $1500 to $3000.

A single individual living in a public apartment pays a minimum of $700 monthly rent for a single-roomed house. Those living in private residences pay double or triple this amount for the same housing description. Note that those in public apartments do share amenities.

Fancy studios and suites in Singapore cost a fortune to rent leave alone purchasing. Some people prefer them since they are elegant with self-contained rooms and modern famishing. These homes don’t go below $4500 in rent every month.

These costs are subject to variations depending on the location of the house away from the city center. Furthermore, some houses don’t allow cooking inside the house. So, you will be forced to rely on alternatives such as takeaway meals and restaurants.

If you have $300,000 to purchase a house, say a three-bedroomed apartment, you will afford a second hand one. Otherwise, buying a condo will require this price tripled. Taking a mortgage on this house will leave you with monthly installments of $1500 – $4500 for 25 years. And this is dependent on your salary. Let’s say you earn averagely. Besides, these terms are only standing after paying a 10% deposit on the house. Not to mention the house is at a considerable distance from the city center.

Daily expenses

These are expenses that enhance your life. They can be basic or secondary goods. Your taste, preference, and lifestyle have a larger bearing on the extent of your budget here. These expenses include food, groceries, drinks, apparel, etc.

Food and drinks:

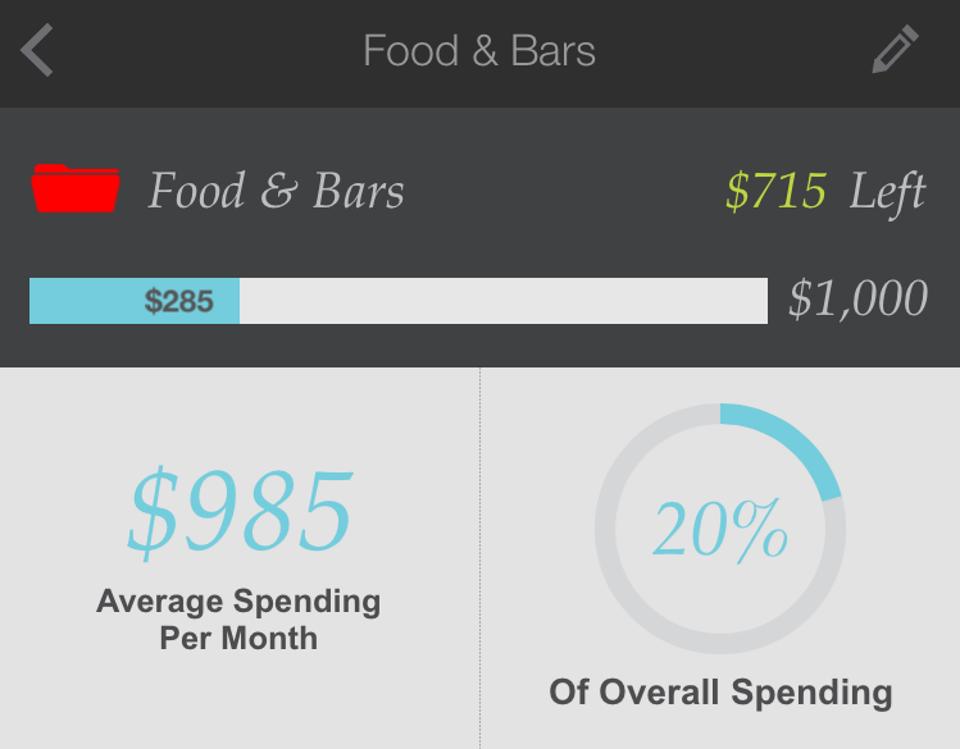

Of course, the amount of money that you spend is just the starting point when it comes to budgeting, but a good start should be the cost of food as well as daily expenses in Singapore. Food is a huge factor in a standard Singaporean lifestyle. Restaurants here are costly, and it’s easy to find yourself eating at the five-star restaurants on the weekend or the super high-end expensive restaurants on weekdays.

Many businesses in Singapore will spend large sums of money on marketing their food in the hopes that they can lure in more business. It’s a good strategy, but that doesn’t mean that it’s right for every business. The reality is that some food outlets in Singapore are right up your alley, and that will allow you to pay a reasonable price for your meal and even eat out once or twice a month.

Groceries:

Groceries sold in Singapore markets are imported. Therefore, you understand how pricey they can get. The price influx is general across the country. Accordingly, every month you should set aside at least $200 for groceries.

Coffee:

Coffee sold on the streets will cost you at least $1, that one sold in shops and hotels is $5. Therefore, depending on your coffee consumption, you should reserve at least $50 to $100

Others:

This category consists of other expenses such as entertainment, vacation, subscriptions, mobile data, gym, etc. These costs also vary. However, your preference for the quantity will inform the amount you use. You could buy a basic package for mobile data and pay for the basic plan of Netflix. It is far much cheaper than subscribing to better data and purchase movie tickets.

Foreigner Loan in Singapore

For applying for a loan in Singapore, you must complete a form that states the kind of loan you want to apply for and what type of security is required for this loan. The information provided by you will be used to prepare your application. Once you have signed the form, the lender will be able to check the details of your past, present, and future financial status. If your record of income is good, you will be able to qualify for a loan in Singapore. You will also be able to learn the kind of loan you will be offered, depending on the type of loan you have chosen.

Living in Singapore will need a higher amount than this. Besides, you need to save, pay for hospital insurance, among other mandatory expenses. Therefore, without a family, a salary of at least $5000 will be ideal for supporting your life system. Having a family is another case altogether. You will need at least triple this. Considering you have to pay for schooling, education is costly. On average, a family needs at least $20,000 in salary to survive in Singapore. On a cheapskate, you will need at least $2000 for a salary. This amount only supports your survival. There are also options to borrow in case you are in need. Visit https://www.a1credit.sg/foreigner-loan and see the loans you are eligible for.