Investing is a complicated process, but it doesn’t have to be. You can choose from any number of different investments, and they all come with their own risks and benefits. Some are safer than others; some provide higher rates of return than others. So how do you know what’s worth making? Here are six investments that are worth making!

#1 Stocks

The first investment that is worth making is stocks. There are a few different types of equity investments, but they all share one thing in common: you’re buying ownership stakes in companies. In the long run, stocks have been shown to provide rates of return as high as 20% or more – and there’s no reason why it can’t happen again!

Of course, investing in individual companies has its risks too. Even some household names like Enron were not immune from bankruptcy after an accounting scandal came to light. It doesn’t mean you should sell your stock portfolio every time something bad happens at a company; just understand how much risk you’re taking on before buying into any given business.

If this sounds daunting and risky, don’t worry – we’re not saying you need to go out and buy individual stocks. There are other ways to invest in equity without taking on too much risk, like index funds or ETFs (exchange-traded funds).

#2 Property

Another investment that is worth making? Property. Owning a home has become the quintessential part of the American dream. Still, it’s not just some nationalistic sentimentality – there are some solid economic reasons why investing in property can be great for your wallet.

Rates of return on real estate tend to average around 12%. But remember, this doesn’t mean you should go out and buy an entire house right now!

It takes time to get enough capital together to invest appropriately in commercial or residential properties, so consider starting small with something like foreclosed homes or REITs (Real Estate Investment Trust). You’ll also need to take into account all the expenses associated with owning rental property; these include insurance costs, maintenance fees, and property taxes. However, these expenses are relatively easy to predict once you’ve had a look at real estate websites and started with the process yourself .

#3 Cryptocurrencies

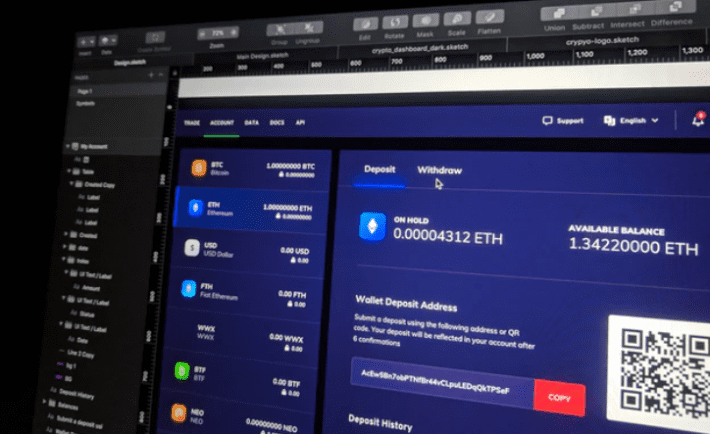

The third investment to make is cryptocurrencies. Cryptocurrencies are a recent development in the financial landscape, but they’ve quickly become one of the fascinating things about investing. They’re not tied to any government or central bank; instead, they rely on an actual mathematical formula that’s designed to scale with its popularity and usage.

Cryptocurrencies have been estimated to provide rates of return up to 24%. But, of course, this also means it has just as much potential for loss if people lose interest or confidence in what you own! And even though there is no physical asset behind cryptocurrency ownership (like property), there can be some serious expenses associated with owning them – like fees for trading platforms and educational seminars explicitly related to digital currencies.

Investing in cryptocurrencies can yield an impressive 24% return. Just be aware of the potential for loss, as well as any fees associated with owning them!

In order to start, you’ll need to download software that allows you to trade in cryptocurrencies. You can get started by visiting a website like Coinbase or downloading an app from the Google Play Store. You should also pay attention to how much each cryptocurrency is worth – since there’s no physical asset behind it, prices fluctuate constantly. There are also educational seminars and trading platform expenses associated with owning them!

#4 Corporate bonds

Another investment worth making is corporate bonds. When you buy a bond, you’re basically loaning money to an organization in exchange for interest payments over time, with the loan’s face value returned when it matures. Corporate bonds have rates of returns that usually average around five percent – but there’s one major caveat: these investments can be quite risky!

Unlike buying stock in a company, where your upside is unlimited if the business does well, and your downside risk is limited by how many shares you own, your return on corporate bonds will only be as high as what has been promised once they mature. And even though most companies get into some kind of trouble eventually (like bankruptcy or financial scandal), not every bond issuer will go bust.

#5 Forex Trading

Another investment worth making is FOREX trading. Forex, or foreign exchange rates, refers to the value of one currency compared to another and can be a powerful tool for investors looking to make money in international markets. But there’s also an element of risk involved with investing in currencies! And that risk isn’t just about market fluctuations – it’s actually how governments regulate these investments themselves.

Many countries have strict laws on what kinds of payment methods are allowed for forex trading, so your best bet might be staying within the boundaries set by your home country if you want any kind of legal protection from fraudsters and other unsavory characters out there.

Investing in forex trades will yield an impressive rate of return. Just be aware of the risks involved with these investments and any government restrictions on them!

You should also pay attention to market fluctuations when trading in currencies – since there’s no physical asset behind it, prices fluctuate constantly. And even though most countries don’t restrict forex trading outright (like some do personal stock ownership), many laws regarding how these trades are carried out could leave you unprotected if fraud is involved.

#6 High-yield Savings Account

Finally, a worthwhile investment option is opening up a high-yield savings account. Because interest rates have been so low in recent years due to the Federal Reserve’s policies, many people forget that there are still places out there where you can earn more than one percent of your money!

But these kinds of accounts aren’t just about getting a better return on what you own – they’re also safer from market fluctuations because most institutions spread their investments across several different avenues for safety. High yield savings accounts provide an impressive rate of return without being as risky as other options. Just be aware of how safe these types of assets really are if economic downturns strike!